Build to Rent Loans.

Town Square Financial introduces the Ground Up Construction Program, meticulously designed for developers and builders ready to embark on new construction projects. Whether you're developing a single residential unit or undertaking a larger project of up to ten units, our program offers the financial backbone necessary to bring your visions to life. With a focus on non-owner occupied residential properties, townhomes, and condos, our financing solutions are tailored to support your projects from inception through completion.

Benefits Of A Build to Rent Loan

High Leverage Financing

Leverage up to 75% of land values and 100% of construction costs, with tailored terms that adjust to the unique needs of your project, ensuring optimal use of your capital.

Adapt to Market Dynamics

With terms up to 24 months at lender discretion, our program provides the flexibility needed to adapt to changes and complete projects without undue pressure.

Diverse Development Opportunities

Focus your efforts on a broad array of eligible properties, excluding only those with complex challenges such as mixed-use or commercial properties, ensuring a smooth and focused development process.

FEATURES

Build to Rent Loan Overview

Our Ground Up Construction Program is structured to facilitate your success in the dynamic real estate development sector:

Detailed Loan to ARV Terms: Utilize up to 70% of the After Repair Value (ARV) to fine-tune your funding strategy according to the project's end-value.

Structured Reserve Requirements: Manage your cash flow effectively with interest reserves tailored to the loan's terms and project demands, including up to six months of interest funding for high-LTC loans.

Third-Party Oversight: Ensure project feasibility and proper fund allocation with mandatory third-party studies and draw monitoring, maintaining integrity and accountability throughout the construction phase.

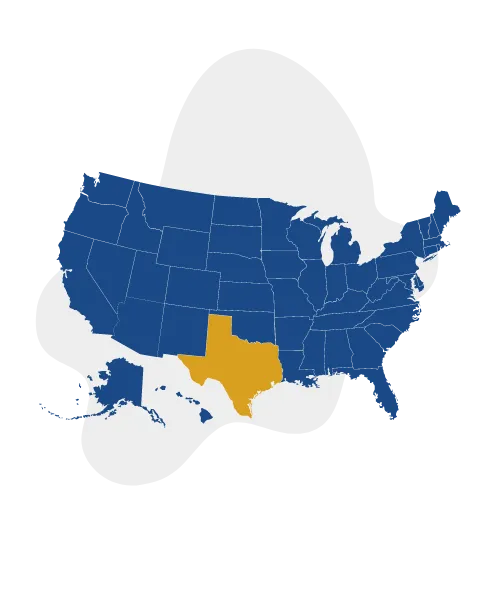

We Lend Nationwide

Town Square Financial proudly extends its services to 44 states across the United States, all from our home base in San Antonio, TX. This expansive coverage ensures that whether you're flipping houses in California, refurbishing townhomes in New York, or expanding a rental portfolio in Florida, our financial solutions are accessible and tailored to meet diverse market conditions. Our San Antonio roots enrich our national presence, blending deep local expertise with a broad understanding of national real estate trends, ensuring you receive knowledgeable support no matter where your investments take you.

FAQ

What types of properties qualify for the Ground Up Construction Program?

Eligible properties include non-owner occupied 1-4 unit residential buildings, townhomes, and condos. Ineligible properties include mixed-use and multifamily units over four dwellings, among others.

What are the credit requirements for applicants?

Applicants must have a minimum FICO mid-score of 680 to qualify for financing under this program.

How are the terms for prepayment penalties structured?

Prepayment structures vary, with options ranging from 1% to 5% penalties decreasing over time, tailored to the loan amount and term length.

What experience is required for program eligibility?

Builders and developers need to have completed at least three similar ground-up projects to qualify for the Experienced Developer Program, ensuring expertise and reliability in project completion.

8552 Murray Grey

San Antonio, TX 78254

Our Company

Town Square Financial,

NMLS # 2609318

Equal Housing Opportunity, © 2024 All Rights Reserved.

Copyright© 2024 Town Square Financial All Rights Reserved.

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval.