Builder Working Capital Loans

This dynamic financing tool is designed to adapt to the unique cash flow needs of your business, functioning similarly to a credit card but with the capability to handle the larger-scale demands of a commercial operation. Access funds, repay, and re-access as needed, providing your business with a continuous, flexible funding source to manage daily operations or seize growth opportunities efficiently.

Benefits Of Builder Working Capital Loan

Sustain Your Business's Growth

After repayment, the principal amount becomes available again for use throughout the lifetime of the line of credit, providing a permanent financial tool for ongoing use.

Funds When You Need Them

With our revolving line of credit, you can access funds immediately after approval, ensuring there is no delay in meeting business needs, whether for unexpected expenses or new opportunities.

Cash Flow Management

Ideal for smoothing out cash flow, especially for businesses with seasonal revenue patterns or varying operational costs, ensuring steady management of payroll, inventory, and other critical business expenses.

FEATURES

Working Capital Loan Overview

Our Working Capital Loans are structured to support your ongoing business needs effectively:

Flexible Repayment Options: Choose to repay more than the minimum during flush periods, reducing your principal balance and accruing less interest over time.

Tailored Withdrawals: Withdraw exactly what you need, when you need it, from minor amounts for short-term needs to larger sums for significant expenses or projects.

Strategic Financial Leverage: Use the line of credit to capitalize on discounts, invest in marketing efforts, or cover project costs that have immediate returns, enhancing your business’s competitive edge.

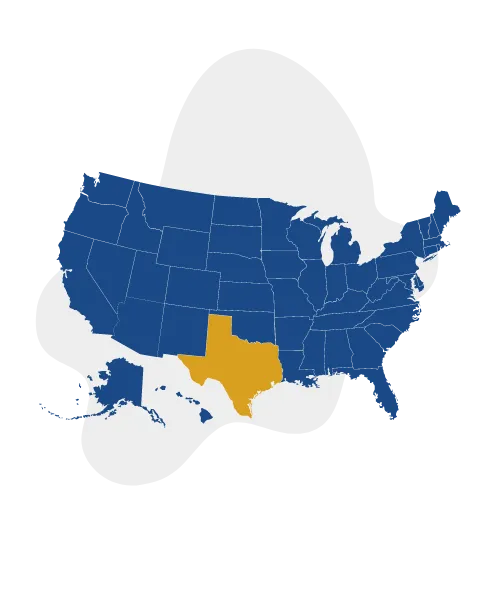

We Lend Nationwide

Town Square Financial proudly extends its services to 44 states across the United States, all from our home base in San Antonio, TX. This expansive coverage ensures that whether you're flipping houses in California, refurbishing townhomes in New York, or expanding a rental portfolio in Florida, our financial solutions are accessible and tailored to meet diverse market conditions. Our San Antonio roots enrich our national presence, blending deep local expertise with a broad understanding of national real estate trends, ensuring you receive knowledgeable support no matter where your investments take you.

FAQ

How quickly can I access funds from the Working Capital Loan?

Once your revolving line of credit is established, you can access funds immediately, providing a quick financial response to any business requirement.

What are the requirements to qualify for a Working Capital Loan?

Applicants should have a strong credit history, demonstrated with a minimum FICO score of 680, and meet our financial assessment criteria.

Can I use the Working Capital Loan for any type of business expense?

Yes, the funds from the line of credit can be used for a wide range of business purposes, from operational expenses to capital investments.

Are there any fees associated with the Working Capital Loan?

Fees are limited to 2.5% over the five-year term, excluding third-party charges such as appraisals and certain taxes and fees which are reimbursed to the lender.

8552 Murray Grey

San Antonio, TX 78254

Our Company

Town Square Financial,

NMLS # 2609318

Equal Housing Opportunity, © 2024 All Rights Reserved.

Copyright© 2024 Town Square Financial All Rights Reserved.

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval.