Rental Property Loan Program

Tailored for investors looking to expand or begin their rental portfolio, our program offers competitive LTVs and flexible financing options across most of the United States. Whether you’re eyeing a single-family residence, a multi-unit property, or a townhome, our program is designed to facilitate your purchase or refinance efficiently, ensuring you capitalize on investment opportunities with ease.

Benefits Of A Rental Property Loan

Optimal Financing Leverage

Enjoy up to 80% LTV for purchases and refinances, and up to 75% for cash-outs, allowing you to leverage more with less upfront capital, depending on your FICO score.

Tailored to Your Investment Timeline

Choose from adjustable-rate mortgages or a 30-year fixed-rate mortgage, including options for interest-only payments during the initial years to enhance cash flow management.

Wide Range of Eligible Properties

Finance a variety of residential property types including 1-4 unit properties, condominiums, and townhomes, giving you the versatility to invest in properties that best suit your strategy.

FEATURES

Rental Property Loan Overview

From competitive loan amounts to tailored terms that suit diverse project needs, we provide the support you need to maximize your investment's potential and achieve your real estate goals efficiently.

Generous Funding Limits: Access funding from $75,000 up to $2,000,000 for 2-4 unit properties, accommodating a broad spectrum of investment scales.

Reserve Requirements: Ensure smooth operations post-closing with required reserves covering initial months of PITI and ongoing tax and insurance obligations.

Prepayment Flexibility: Tailor your payment plans with various prepayment penalty options, allowing you to strategize your finances effectively over the loan term.

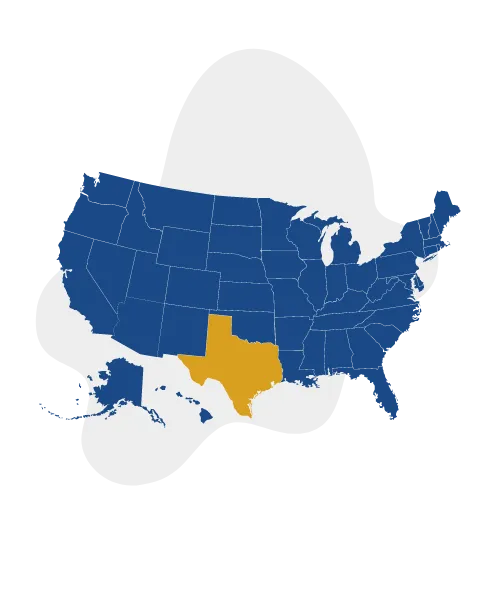

We Lend Nationwide

Town Square Financial proudly extends its services to 44 states across the United States, all from our home base in San Antonio, TX. This expansive coverage ensures that whether you're flipping houses in California, refurbishing townhomes in New York, or expanding a rental portfolio in Florida, our financial solutions are accessible and tailored to meet diverse market conditions. Our San Antonio roots enrich our national presence, blending deep local expertise with a broad understanding of national real estate trends, ensuring you receive knowledgeable support no matter where your investments take you.

FAQ

What are the FICO score requirements for your Rental Property Loans?

Our loans cater to a range of FICO scores, offering different LTV rates starting from a 660 minimum score, ensuring flexibility based on your credit standing.

Can I finance a rental property in any state?

Our Rental Property Loans are available in all states except MN, ND, OR, SD, VT, and UT, with specific requirements for properties in NV and AZ.

What types of rental properties are ineligible for financing?

Properties that are mixed-use, contain more than four units, or fall into unique categories like condotels and mobile homes are not eligible under our program.

What is the maximum loan term available for your rental property loans?

We offer up to 30 years of amortization, with flexible terms including 5, 7, or 10 years of interest-only payments depending on the loan structure chosen.

8552 Murray Grey

San Antonio, TX 78254

Our Company

Town Square Financial,

NMLS # 2609318

Equal Housing Opportunity, © 2024 All Rights Reserved.

Copyright© 2024 Town Square Financial All Rights Reserved.

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval.