Spec Construction Loans.

Unlock the potential of your development projects with Town Square Financial’s Spec Construction Loans. Designed for builders and developers at all levels of experience, our loans offer competitive financing options tailored to support your specific construction needs. Whether you're breaking ground on a new project or expanding your development portfolio, our spec construction loans provide the flexible terms and financial leverage needed to drive your projects forward efficiently.

Benefits Of A Spec Construction Loan

High Leverage Financing

Benefit from maximum loan-to-cost (LTC) up to 100% if land is subordinated, and loan-to-value (LTV) options scaling up to 75%, depending on your project and experience level.

Competitive Loan Terms

Benefit from maximum loan-to-cost (LTC) up to 100% if land is subordinated, and loan-to-value (LTV) options scaling up to 75%, depending on your project and experience level.

Tiered System

Our loans are tailored to your experience, with better terms available for more experienced developers, ensuring you receive financing that reflects your track record and capabilities.

FEATURES

Spec Construction Loan Overview

Construction Loans are structured to accommodate a variety of project scopes and developer experiences, from novice builders to seasoned professionals:

Interest Rates: Competitive rates starting at 7.99%, adjusting based on project and developer qualifications.

No Monthly Payments: Benefit from a pay rate of 0.00%, with points payable at maturity, easing cash flow during critical construction phases.

Extension Options: Initial terms of 10 or 12 months with a 4-month extension option available, providing flexibility to manage unexpected project delays.

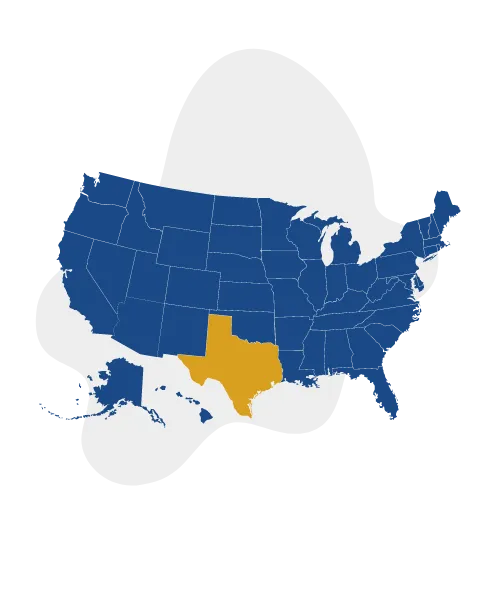

We Lend Nationwide

Town Square Financial proudly extends its services to 44 states across the United States, all from our home base in San Antonio, TX. This expansive coverage ensures that whether you're flipping houses in California, refurbishing townhomes in New York, or expanding a rental portfolio in Florida, our financial solutions are accessible and tailored to meet diverse market conditions. Our San Antonio roots enrich our national presence, blending deep local expertise with a broad understanding of national real estate trends, ensuring you receive knowledgeable support no matter where your investments take you.

FAQ

What types of properties are eligible for Spec Construction Loans?

Eligible properties include non-owner occupied 1-4 unit residential properties, townhomes, and condos. Ineligible properties include commercial properties and multifamily units over four dwellings.

What are the repayment terms for these loans?

Loans feature an initial term of 10 to 12 months, with an optional 4-month extension. Interest rates range from 7.99% to 10.99%, and points are due at loan maturity.

How is the loan amount determined for my project?

Loan amounts are based on a combination of the project's cost, your experience level, and the property's appraised value or purchase price, with maximum amounts up to $3,500,000.

Are there any geographical restrictions for these loans?

Loans are available in most US states, except for MN, ND, OR, SD, UT, and VT, with special requirements for properties in NV and AZ.

8552 Murray Grey

San Antonio, TX 78254

Our Company

Town Square Financial,

NMLS # 2609318

Equal Housing Opportunity, © 2024 All Rights Reserved.

Copyright© 2024 Town Square Financial All Rights Reserved.

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval.